U.S. economic data was mixed last week. Initial unemployment claims decreased 42,000 to 346,000 for the week ended April 6th. However, retail sales for March fell 0.4% compared to an

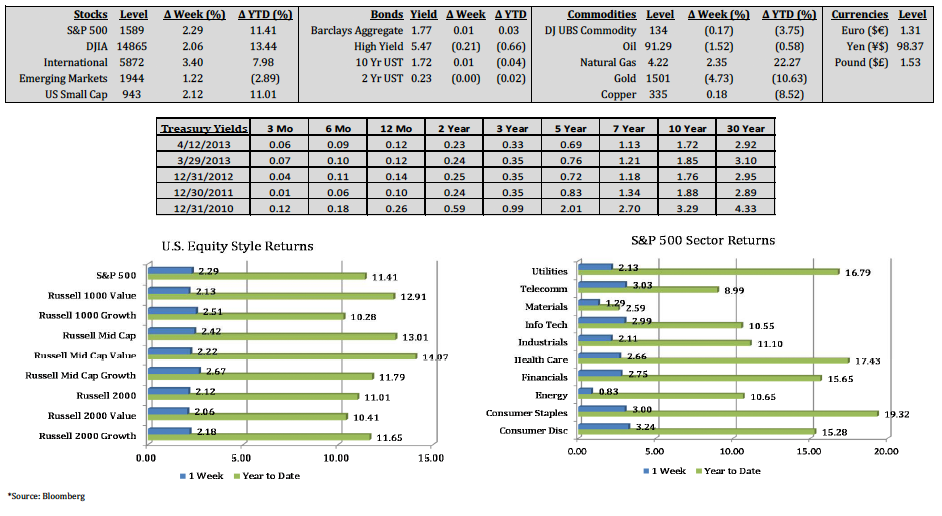

expected decline of 0.1%. The S&P 500 Index gained 2.29% and the DJIA rose 2.06%, both new highs. All S&P 500 Index sectors were positive. Consumer discretionary (3.24%),

telecommunications (3.03%), and consumer staples (3.00%) led performance, while energy (0.83%) and materials (1.29%) posted the smallest gains for the week. The U.S. dollar closed the

week at ¥98.37, having gained 28% against the yen in the last six months. The yield on the 10‐year U.S. Treasury rose by 1 basis point to 1.72%. Gold entered bear market territory as it

dropped ‐4.73% last week.

International equity markets posted a gain of 3.40%, and emerging market equities rose 1.22%. Japan posted its first current account surplus in four months, and increased demand for

Japanese exports drove business confidence higher. The Nikkei Stock Average rose 5% to its highest level since June 2008. Fitch lowered a key rating on Chinese government debt over

concerns of massive lending from China’s bank and nonbank lenders. The country’s CPI increased 2.1% in March compared with the prior year. The index rose 3.2% in February. Chinese

imports increased 14% in March vs. a decrease of 15% in February. After a negotiated bailout weeks ago for Cyprus, the country still requires an additional €5.5 billion in bailouts. They are

discussing selling existing gold reserves.

(Click image to enlarge)