China’s GDP grew 7.7% year‐over‐year in the first quarter, an unexpected slowing and down from 7.9% in the final quarter of 2012. Because of wide‐scale global weakness, investors

responded by selling off stocks and commodities, including gold, silver and copper. The price of a barrel of oil fell to $88. Gold futures tumbled more than 9% on Monday in the biggest one‐day

selloff in decades, reaching a two‐year low of $1,361 an ounce, rebounding to end the week at $1,396. The bombings of the Boston Marathon on Monday and generally poor U.S. economic data

also added to the unease already present from poor economic news.

In the U.S., the leading economic indicators dropped in March for the first time in seven months. The Federal Reserve Bank of Philadelphia’s factory index fell in April. First‐time jobless claims

rose by 4,000 to 352,000 in the week ended April 13. The Consumer Price Index fell 0.2% in March, rising just 1.5% year to year. Housing starts rose 7% in March to post their strongest

monthly data since June 2008. Quarterly corporate earnings reports provided a mixed picture, with IBM and Bank of America disappointing.

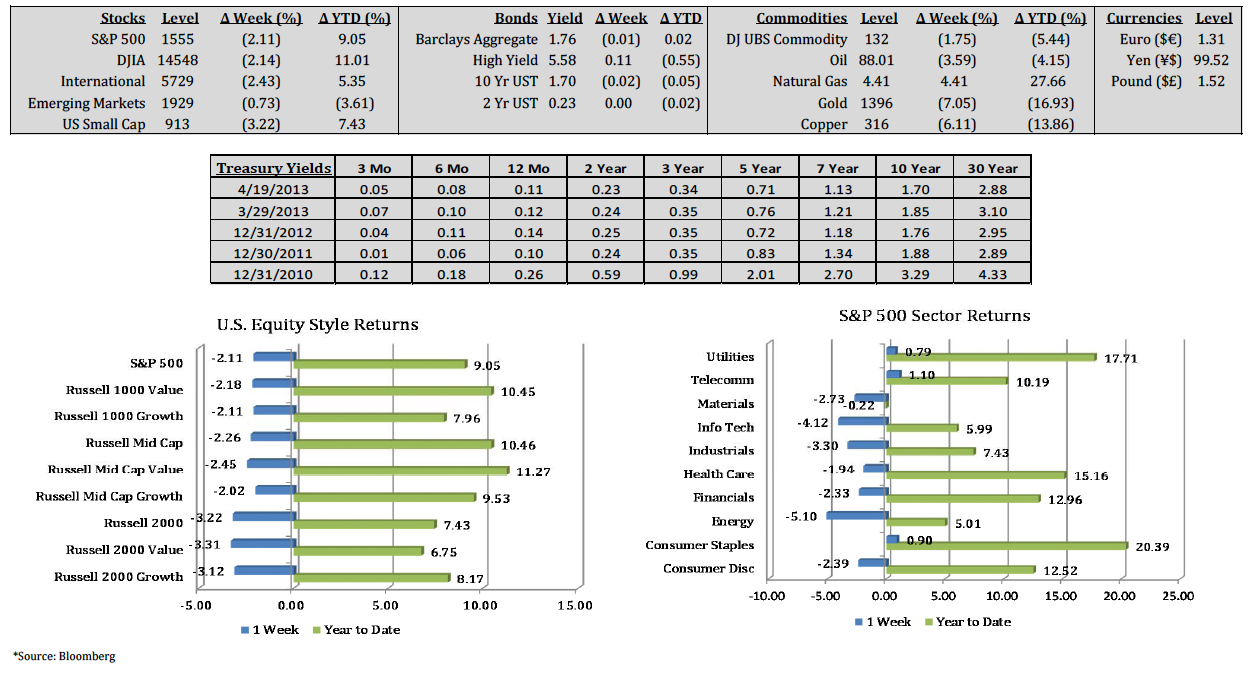

The S&P 500 Index dropped ‐2.11%, and the DJIA fell ‐2.14% last week. The only positive S&P 500 sectors were telecommunications (1.10%), consumer staples (0.90%), and utilities (0.79%).

The largest detracting sectors were energy (‐5.10%), technology (‐4.12%), and industrials (‐3.30%). International equity markets posted a loss of ‐2.43% for the week, while emerging markets

equities dropped ‐0.73%.

(Click image to enlarge)