U.S. equity indexes reached new records on signals that the Eurozone may be turning around and a higher than expected U.S. GDP report for the second quarter. US gross domestic product grew

at an annualized 1.7% pace in the second quarter, ahead of the 0.9% forecast by economists and faster than the first quarter’s 1.1% pace, which was revised downward. The number of US jobs

grew by only 162,000 in July, fewer than the predicted 183,000 or the average monthly gain of 189,000 over the past year. The jobs totals for May and June were revised down by a combined

26,000. The unemployment rate fell to 7.4% from 7.6%, but fewer people are seeking work. US manufacturers reported a major improvement in July, with the ISM index jumping to 55.4 from

50.9 in June. The ISM production index rose to a nine-year high, while new orders and the indicator for employment spiked as well. US consumer confidence fell slightly in July, according to the

Conference Board. Household purchases rose 0.5% in July. The S&P/Case Shiller index reported a 1% monthly gain in home prices in May.

Eurozone manufacturing activity expanded in July for the first time in two years as the manufacturing PMI rose to 50.1 from 48.8 in June. The European Union’s overall unemployment rate also

improved. However, 10.9% of the European Union workforce was unemployed in June. China’s official manufacturing PMI rose from 50.1 to 50.3 in July. However, the HSBC PMI, which includes

smaller export-oriented firms, fell to 47.7 from 48.2.

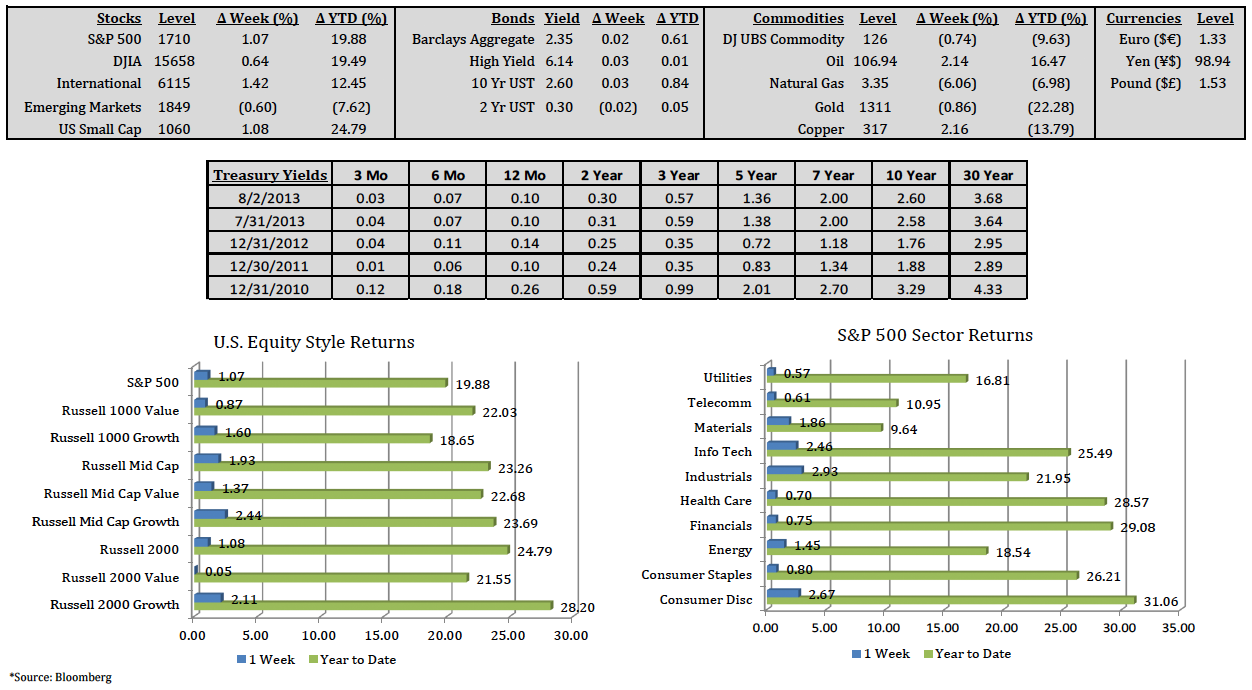

The S&P 500 Index gained 1.07% last week, and the DJIA rose 0.64%. Both indexes are up nearly 20% year to date. All ten of the S&P 500 Index sectors posted gains. Industrials, consumer

discretionary, and technology led all sectors, while utilities, telecomm, and health care posted the lowest gains for the week. Crude oil gained 2.14%, and gold dropped -0.86%. The yield on the

10 Year Treasury closed the week at 2.60%.

(Click image to enlarge)