A decline in consumer spending and business investment prompted a revision of US GDP growth from 2.4% down to 1.8% in the first quarter. Markets rallied following this report, assuming a

reprieve from rising rates. Durable goods orders rose 3.6% in May for the second straight month. Personal spending increased 0.3% and personal incomes rose 0.5% in May. Initial jobless

benefits claims fell 9,000 to 346,000 for the week ended June 22nd. The four‐week moving average fell 2,750 to 345,750. The S&P/Case‐Shiller home price index gained 12.1% in April, its

largest annual increase since 2006. New home sales rose in May to their highest level since July 2008, and contracts to purchase previously owned homes reached their highest point in more

than six years. The 30‐year fixed mortgage rate rose from 3.93% to 4.46%, its largest weekly percentage gain in more than 25 years.

Japan’s manufacturing activity expanded in June at its fastest pace in over two years. The gauge rose to a seasonally adjusted 52.3 from 51.5 in May. Japan’s unemployment rate held steady at a

seasonally adjusted 4.1% in June. Industrial production increased 2% in May, according to a different gauge, and retail sales rose 0.8% from a year earlier. The country’s core CPI was flat in May

compared with a year earlier. Mario Draghi said he expects the ECB’s monetary policy to remain accommodative for quite some time. However, the monthly Eurocoin measure of regional

output pointed to contraction in June.

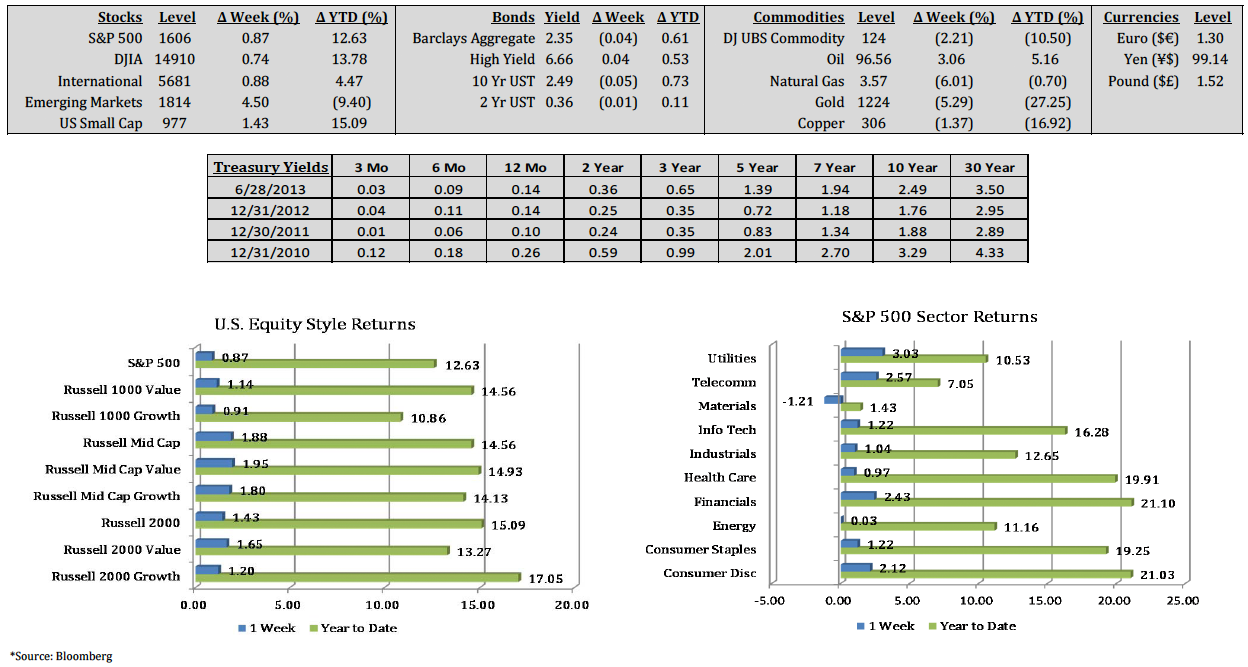

The S&P 500 Index rose 0.87%, and the DJIA gained 0.74% last week. Nine of ten S&P 500 sectors posted gains, while materials lost ‐1.21%. Utilities, telecommunications, and financials posted

the largest positive returns, while materials, energy, and health care were the poorest performers. Crude oil gained 3.06%, and gold closed the week down 5.29%, falling below $1,200 at one

point. The 10 year US Treasury yield finished the week at 2.49%.

(Click image to enlarge)