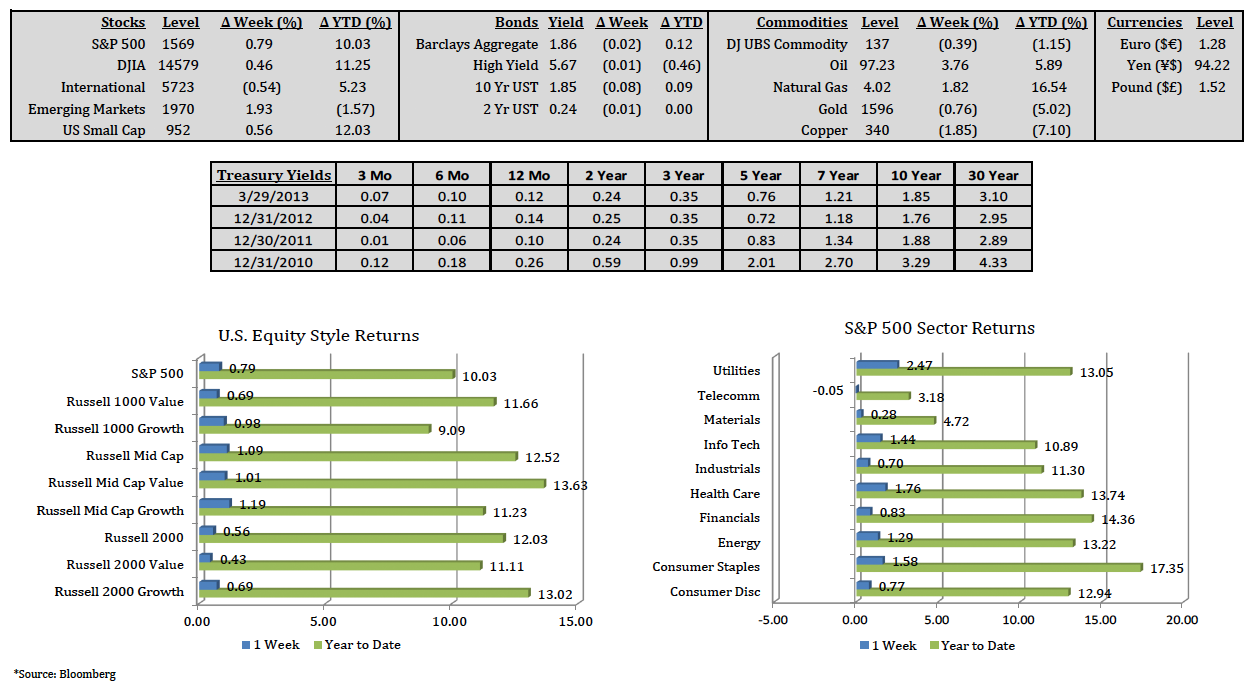

Equities posted gains in a shortened week due to the Easter holiday. The S&P 500 Index gained 0.79% and the DJIA rose 0.46% last week. Telecommunications was the only negative sector for

the week with a -0.05% loss, while utilities and health care posted the largest gains, 2.47% and 1.76% respectively. The third and final reading of U.S. gross domestic product for the fourth

quarter of 2012 showed an increase at an annual rate of 0.4%. The upward revision was driven by construction spending, which increased business fixed investments by 13.2%. U.S. home

prices gained 8.1% in January from a year earlier, the biggest annual price gain in six and a half years. All 20 cities in the S&P/Case-Shiller Index posted annual increases in January.

International equity markets posted a -0.54% drop last week, while emerging markets equities were up 1.93%. Cyprus obtained a €10 billion bailout last Monday in a deal that closed Cyprus

Popular Bank, the country’s second largest bank. The country’s largest bank, Bank of Cyprus, will be significantly scaled back. The Economic Sentiment Indicator, covering the entire Eurozone

region, fell to 90.0 in March from 91.1 in February. Sentiment improved in Italy, Greece and Portugal but weakened in Germany, France and Spain.

(Click image to enlarge)