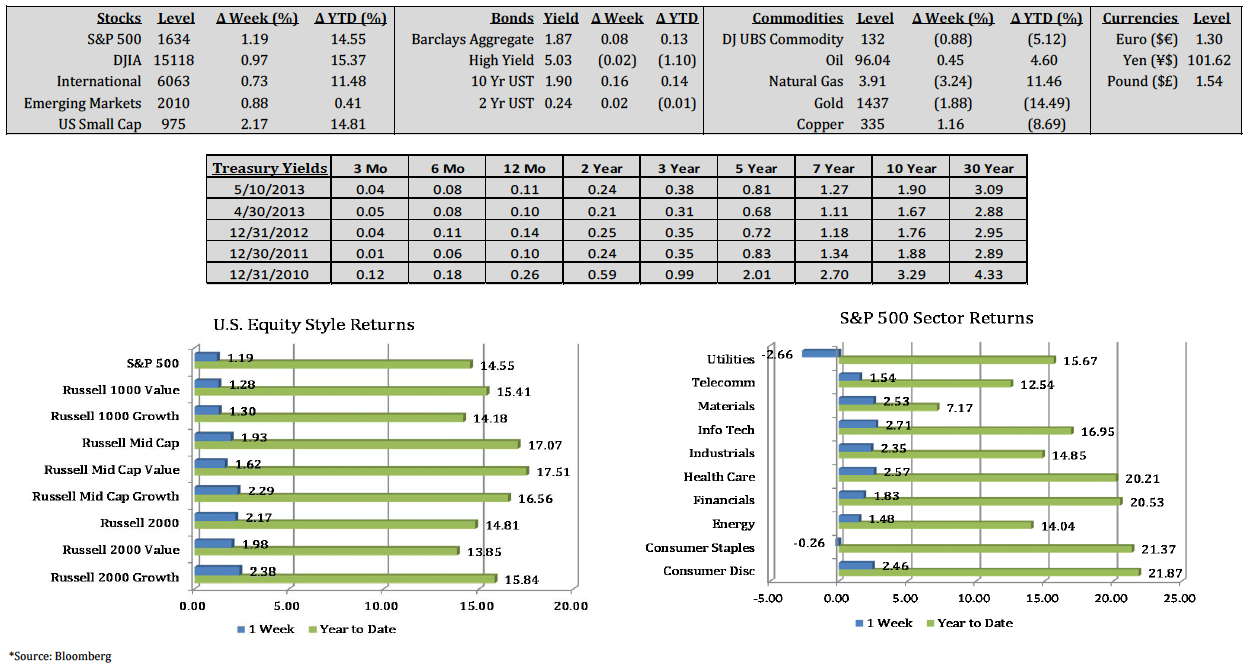

The Dow Jones Industrial Average and S&P 500 reached all‐time highs last week, 1,634 and 15,118 respectively, on favorable employment and housing news. Weekly initial jobless claims fell

4,000 to 323,000, the lowest level since January 2008. The four‐week rolling average declined by 6,250 to 336,750, its lowest since November 2007. Fannie Mae said it would repay $59.4 billion

to the US government next month. High yield U.S. bond yields dipped below 5% for the first time ever, as investors search for yield. The US dollar broke the ¥100 level for the first time in four

years, closing the week at ¥101.62. 452 companies of the S&P 500 Index have reported earnings, indicating a 1.4% drop in sales and an increase in earnings of 2.3%.

The Nikkei Stock Average, up 68% since mid‐November, has gained 18% since April 4th, the date of the Bank of Japan’s announcement to inject yen into the markets. While annual consumer

inflation in China rose 2.4% in April, their producer price index fell 2.6%, its fourteenth consecutive monthly decline. Portugal raised €3 billion in its first 10‐year bond sale since its bailout in

2011.

The S&P 500 rose 1.19%, and the DJIA gained 0.97% for the week. Eight of ten S&P 500 sectors posted positive returns, while utilities (‐2.66%) and consumer staples (‐0.26%) were the only

negative sectors. Technology (+2.71%), health care (+2.57%), and materials (+2.53%) were the three leading sectors in the index. Crude oil gained 0.45%, and gold fell ‐1.88%.

(Click image to enlarge)