Lower energy costs drove U.S. producer and consumer monthly prices down in April. The CPI fell 0.4% in the month of April and rose 1.1% for the 12 months ended in April. Producer prices

also declined. Energy prices fell 4.3% and gasoline prices fell 8.1% in April. Housing starts dropped 16.5% during the month, and building permits rose 14.3%. Initial claims for unemployment

benefits climbed to 360,000 for the week ended May 11th, higher than the expected 330,000.

Japan’s economy grew at a 3.5% annualized rate in the first quarter. Exports rose, partially due to a weaker yen, and consumer spending increased. Economic output in the eurozone dropped

for the sixth consecutive quarter in the first quarter of 2013. Overall GDP fell 0.2% in the first quarter from the previous period. The region also posted its largest trade surplus ever in March,

driven primarily by a decline in imports.

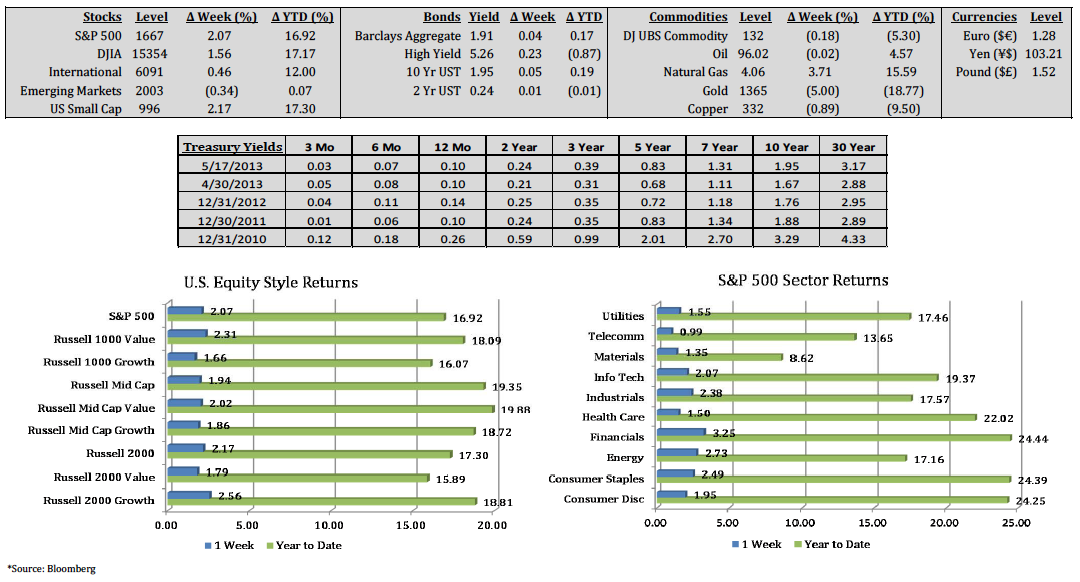

The S&P 500 gained 2.07% and the DJIA rose 1.56% last week. All ten S&P 500 sectors posted gains. Financials (+3.25%), energy (+2.73%), and consumer staples (+2.49%) led the index, while

telecommunications (+0.99%), healthcare (+1.50%), and utilities (+1.55%) posted the smallest gains. For the week, gold dropped another 5.00%, increasing its year to date decline to 18.77%.

The dollar rose above 103¥ for the first time in four years, and U.S. 10‐year Treasury yields rose to 1.95%.

(Click image to enlarge)