Earnings seasons and unemployment results were the major news bits for the week. With 80% of S&P 500 companies reporting, results have been uninspiring as sales have fallen 1.4% and

earnings increased 2.4%. April jobs report produced a gain of 165,000 (140,000 forecasted), to bring the unemployment rate to 7.5%, the lowest level since 2008. Despite anemic

fundamentals, equities posted gains for a second consecutive week, as the S&P 500 Index set a new high. The price of U.S. homes rose 9.3% in February from a year earlier, according to the

S&P/Case-Shiller index. All 20 cities in the index recorded two straight months of price increases.

The ECB cut its key interest rate by 0.25% to 0.50% in response to the eurozone’s languishing economy. Japan’s key economic indicators, including industrial output and household spending,

improved in March. Yields on Italian 10-year government bonds fell to 3.72%. Spanish 10-year yields fell below 4%, as markets signaled their approval of the ECB rate cut and of the formation

of Italy’s coalition government. Germany’s two-year note dropped below zero, and the 10-year bund’s rate fell to its lowest level since July.

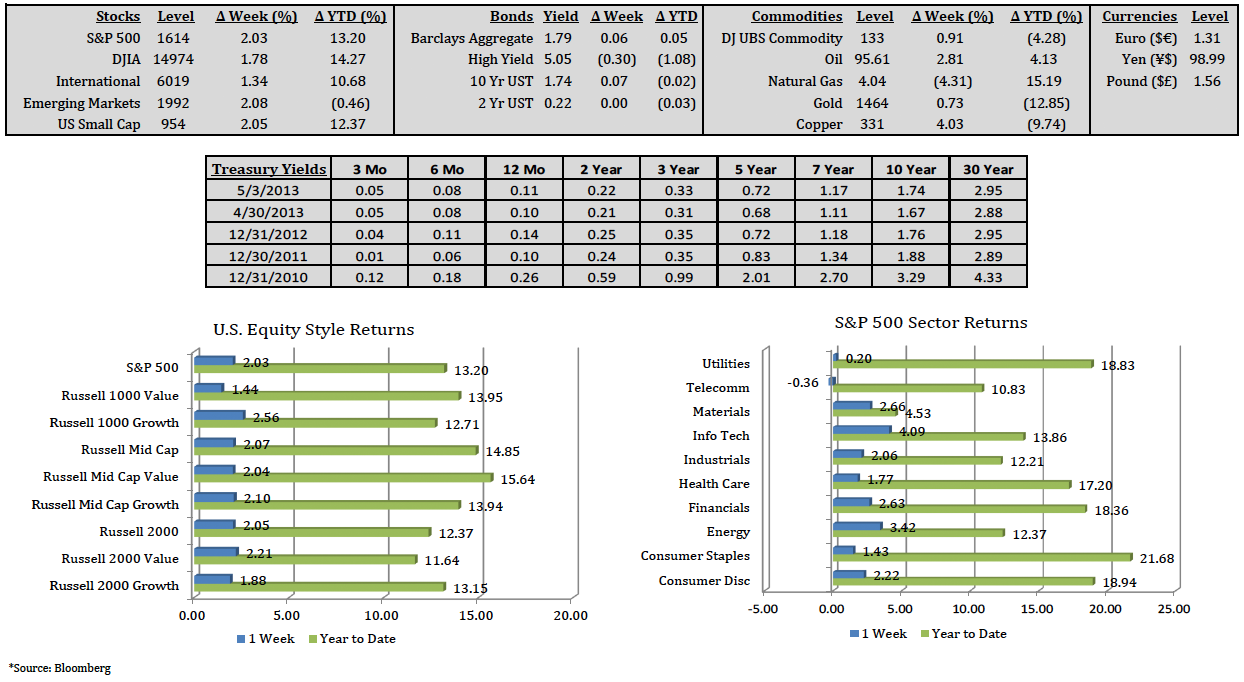

The S&P 500 gained 2.03% (closing at 1,614) and the DJIA rose 1.78% last week. Nine of ten sectors in the S&P 500 were positive with telecommunications being the only negative sector.

Technology (4.09%), energy (3.42%), and materials (2.66%) were the three top performing sectors, while telecomm (-0.36%), utilities (0.20%), and consumer staples (1.43%) were the

poorest performing sectors in the index. Crude oil gained 2.81% and gold rose 0.73% last week.

(Click image to enlarge)