Equities dropped across the board after a volatile week. U.S. GDP growth was revised downward to 2.4% from 2.5% in the first quarter, due to a smaller buildup of private inventory than first

estimated. Jobless claims rose by 10,000 to a seasonally adjusted 354,000 in the week ended May 25th. Consumer confidence increased to 76.2, a five‐year high. Home prices increased by

10.9% in March from a year earlier, the largest annual gain in seven years. Foreclosures on US homes dropped 22% in the first quarter. The yield on the 10‐year Treasury fluctuated between

2.10% and 2.20%, closing the week at 2.13%.

Eurozone unemployment reached 12.2% in April, a new record. Spain had the highest rate of joblessness of any country at 26.8%, in sharp contrast to Germany and Austria, at 5.4% and 4.9%

respectively. Japan’s Nikkei Stock Average fell sharply and Asian stocks retreated. Industrial production in Japan grew 1.7% in April. However, a separate report indicates a 0.4% decline in

Japan’s core CPI in April. India’s economy grew at its slowest rate in a decade, slowing to 5.0% growth in the year ending March 31st. India grew 6.2% in 2012.

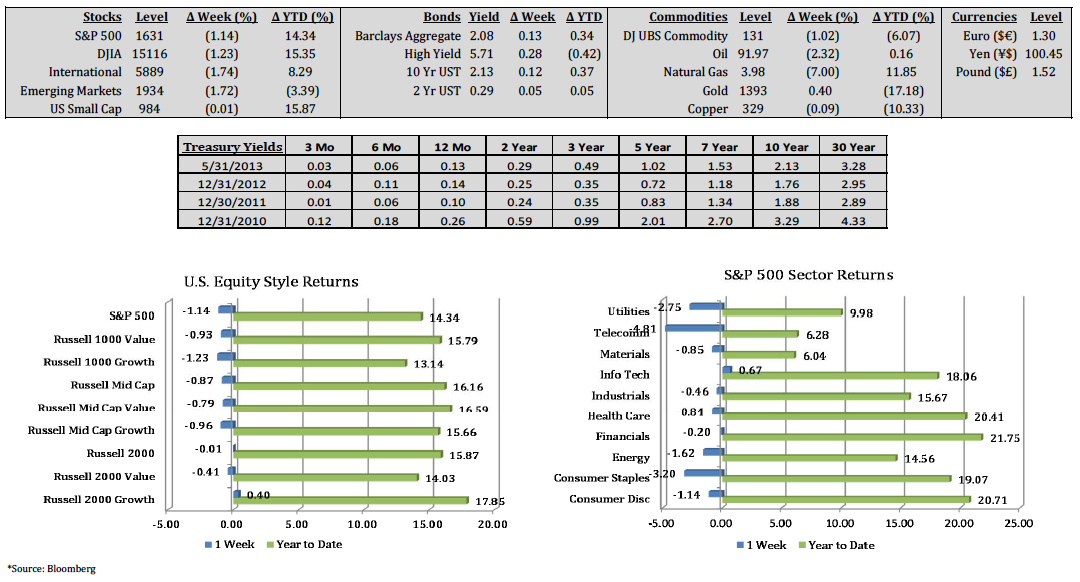

The S&P 500 Index dropped ‐1.14%, and the DJIA lost ‐1.23% last week. For the month of May, the S&P 500 Index finished up 2.1%, and the DJIA gained 1.9%. Nine of ten S&P 500 sectors were

negative for the week, while technology was the only positive sector. Technology (+0.67%), financials (‐0.20%), and industrials (‐0.46%) were the three leading sectors, and telecomm (‐4.81%),

consumer staples (‐3.20%), and utilities (‐2.75%) were the poorest performers. Gold gained 0.40% to reach $1,393, while crude oil dropped ‐2.32%, closing at $91.97.

(Click image to enlarge)